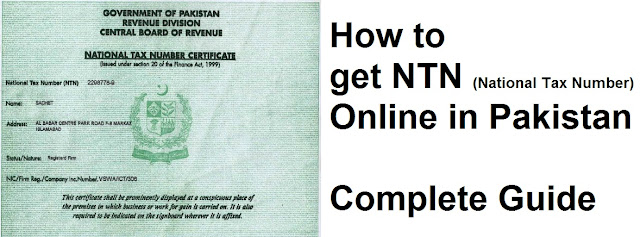

If you are a taxable person and you are not paying any tax to FBR in Pakistan than you will be called as non-filer which will get you in trouble like blocking of your bank accounts, sealing of your company or work station and even you will get very solid penalty by law from Federal Board of Revenue Pakistan. So that we advise you to learn how to register NTN (National Tax Number) through FBR official website online in Pakistan.

Applying for NTN and its file was not that easier in Pakistan but now thanks to the FBR team that they are providing this facility to each and every Pakistani national and other country’s business persons to get their NTN online by giving some details like CNIC, Address, Name and Business details. So if you want to get your NTN (National Tax Number) by filling a simple online registration form at FBR website than follow the below steps and get your NTN now.

How to Apply for NTN (National Tax Number) Online in Pakistan:

- Go to the FBR website: https://e.fbr.gov.pk/AuthLogin.aspx

- Login screen will appear on FBR website now scroll down and click on Registration for Unregistered Person at the footer of the page

- Select whether you are individual (salaried or free person) or a company (organization or service provider) its a must

- Now provide personal details like CNIC number, email address, personal phone number, full and real address.

You will receive an email with a code then put that code in the required box of FBR website and click on Submit - If FBR website asks for more information than provide and click on Submit button

Also you may need to create a password for login into your FBR account and for this you can do it on the screen which appears after clicking on Submit button so you can easily access your NTN (National Tax Number) from anywhere to provide details about your filer status for buying anything like a Car or registering something.

Now after your submission you will easily obtain your NTN (National Tax Number) as FBR needs no more information from your side.

Manual Registration of NTN (National Tax Number)

On FBR’s official website you can download and printout the NTN application (Download FBR TRF-01 Form) form to manually get it registered under your name. You have to print that form and fill it accordingly than submit it to the regional FBR office for getting your NTN (National Tax Number) for free.

Get a list of FBR offices around the map of Pakistan right below.

Federal Board of Revenue FBR Helpline Numbers and Office Addresses

| FBR Office Islamabad | FBR Office Lahore | FBR Office Karachi |

| Regional Tax Office, Plot No. 20, Mauve Area, G-9/1 Islamabad.Ph: 051-9070000 Email: [email protected] |

Incharge NTN Cell, 1st Floor, Billaur Palace,Mcleod Road, Lahore.Ph # 042-7312732 |

Incharge NTN Cell, 3rd Floor, Income Tax Building, Shahrah-e-Kamal Attaturk, Karachi.Ph # 021-9211330 / 021-9211068 Fax # 021-9212534 |

| FBR Office Sukkur | FBR Office Multan | FBR Office Faisalabad |

| Incharge NTN Cell, Ground Floor, Income Tax House, Queens Road, SukkurPh # 071-9310149 Fax # 071-9310148 |

Incharge NTN Cell, 56, Tariq Road, Income Tax House, Multan.Ph # 061-9201101 Fax # 061-9201102 |

Incharge NTN Cell, Second Floor, Income Tax Building, Opp: Allied Hospital, Sargodha Road, Faisalabad.Ph # 041-9210310 Fax # 041-9210126 |

| FBR Office Gujranwala | FBR Office Sialkot | FBR Office Peshawar |

| Incharge NTN Cell, Ground Floor, Income Tax Buildig, G. T. Road, GujranwalaPh # 055-9200797 |

Incharge NTN Cell, Ground Floor, Income Tax Building, Katchery Road, SialkotPh # 052-9250430 Fax # 052-9250429 |

Incharge NTN Cell, Ground Floor, Regional Taxpayer’s Office ( RTO’s), Income Tax Building, Jamroud Road, PeshawarPh # 091-9206091 Fax # 091-9206092 |

| FBR Office Quetta | FBR Office Hyderabad | FBR Office Bahawalpur |

| Incharge NTN Cell, Ground Floor, Income Tax Office, Spinny Road, QuettaPh # 081-9202185 Fax # 081-9201376 |

Incharge NTN Cell, Ground Floor, Income Tax Building, Civil Lines, Hyderabad.Ph # 022-2782961 / 022-2782962 Fax # 022-9200205 |

Incharge NTN Cell, Computer Center, 32-C, Near H.B.L, Model Town-A, Shabbir Shaheed Road, BahawalpurPh # 062-9255280 / 062-9255281-83 |

| FBR Office Sahiwal | FBR Office Sargodha | FBR Office Rawalpindi Main Income Tax Building 12-Mayo Road، Airport Road # (051) 9270405 |

| Incharge NTN Cell, Income Tax Complex, Canal Colony, SahiwalPh # 040-9200089 Fax #040-9200180 |

Incharge NTN Cell, Pral Regional Tax Office Unoversity Road SargodhaPh # 048-9239082 |

How to Verification of NTN (National Tax Number)

Everyone can verify NTN from online portal of FBR and its just as simple as typing abc. You only have to visit FBR NTN verification page and enter your NTN (National Tax Number), Passport Number or CNIC and get typing in your details hit the search button and you will get your NTN (National Tax Number) details with full information about your NTN and regional office.

So the registration and application for NTN (National Tax Number) and Verification information has been posted on this page, for any other information stay active on the homepage of www.TaleemWala.com